Section 12B Solar Investment VI

Our sixth Section 12B Solar Investment offers taxpayers a compelling opportunity to de-risk up to 75% of their initial investment within 18 months, and benefit from a shorter 7-year investment term.

Beyond the immediate tax benefits, investors will participate in a diversified portfolio of solar projects, generating stable cash flows and offering risk mitigation through diversification.

The capital raised will be invested into a well-diversified portfolio of established commercial and industrial solar projects, each backed by long-term agreements with reliable energy users. With project sizes from 100 kW to over 1 MW, investors benefit from scale, stability, and attractive deployment opportunities.

With one of the sector’s leading in-house technical teams, we have established ourselves as South Africa’s largest Section 12B solar fund manager. Our track record reflects both expertise and scale:

|

We’ve raised and committed over R1 billion across 250+ solar projects |

|

98% of our solar portfolio has a positive payment track record |

|

Over 600 taxpayers have entrusted their capital with us |

|

We’ve deployed more than 110% of equity raised within the first year |

|

We’ve invested in solar projects which are projected to generate double-digit IRRs |

| Tax Deduction: Up to 166% | |

| De-risked: Up to 75% in under 18 months | |

| Sector Focus: Commercial, Industrial and Residential | |

| Minimum Investment: R500,000 | |

| Limited Capital Raise: R200 million | |

| Reduced Investment Term: Target to exit investors after 7 years | |

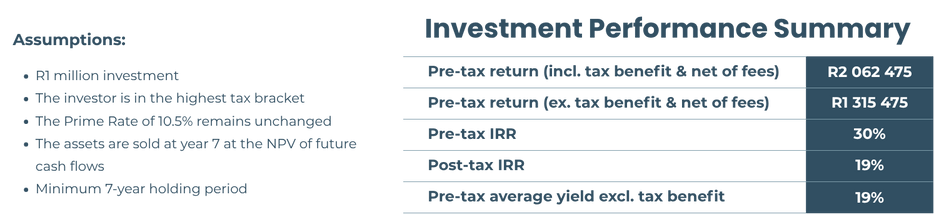

| Target IRR (Pre-Tax): 30% (net of fees, inclusive of the tax benefits) | |

| Projected Average Income Yield (Pre-Tax): 19% | |

| Risk Profile: Moderate |

| Tax Deduction: Up to 166% | |

| De-risked: Up to 75% in under 18 months | |

| Sector Focus: Commercial, Industrial and Residential | |

| Minimum Investment: R500,000 | |

| Limited Capital Raise: R200 million |

|

Reduced Investment Term: Target to exit investors after 7 years |

|

|

Target IRR (Pre-Tax): 30% (net of fees, inclusive of the tax benefits) |

|

| Projected Average Income Yield (Pre-Tax): 19% | |

| Risk Profile: Moderate |

This investment has been structured to maximise tax efficiency by targeting an equity-to-debt ratio of 1:0.66. In practical terms, for every R1 million invested, we aim to raise approximately R660,000 in debt. This effectively increases the total allowable tax deduction to up to R1,660,000.

| A 100% tax deduction on their capital invested in year 1, and | |

| A 100% tax deduction on the debt portion in year 2. |

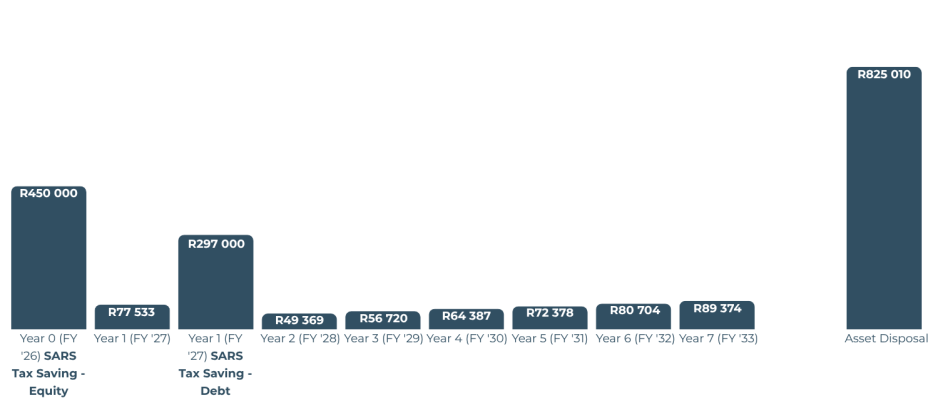

By way of illustration, an investor in the top tax bracket who invests R1 million will be entitled to a total tax deduction of up to R1,660,000 (R1 million in the 2026 financial year, and R660,000 in the 2027 financial year). Considering the tax savings and income distribution in the first year, investors can expect up to R747,000 returned to them by the end of the 2027 financial year.

This investment has been structured to maximise tax efficiency by targeting an equity-to-debt ratio of 1:0.66. In practical terms, for every R1 million invested, we aim to raise approximately R660,000 in debt. This effectively increases the total allowable tax deduction to up to R1,660,000.

| A 100% tax deduction on their capital invested in year 1, and | |

| A 100% tax deduction on the debt portion in year 2. |

By way of illustration, an investor in the top tax bracket who invests R1 million will be entitled to a total tax deduction of up to R1,660,000 (R1 million in the 2026 financial year, and R660,000 in the 2027 financial year). Considering the tax savings and income distribution in the first year, investors can expect up to R747,000 returned to them by the end of the 2027 financial year.

Investors are projected to receive an average annual pre-tax cash yield (excl. the tax benefit) of between 17% and 19%, for 7 years. This is in addition to the tax savings in the first two years.

We have a robust pipeline of commercial and industrial solar projects to deploy investor capital before the end of February 2026. The pipeline consists primarily of existing assets, which carry limited construction risk and have a strong track record of performance and payment history. We are in the process of finalising several solar transactions, and while we remain optimistic about successfully concluding multiple deals, no assurances can be provided at this stage. The number and scale of completed transactions will impact the amount of committed capital drawn down and deployed.

Investors will gain exposure to a diversified portfolio of solar projects, reducing the risk associated with reliance on a single project or counterparty. By spreading investments across multiple projects, the portfolio provides enhanced risk mitigation, as underperformance or delays in one project have minimal impact on overall returns. This diversification also supports stable and predictable cash flows, with revenue generated from a broad base of off-takers across different sectors and regions. The portfolio’s scale and breadth provide resilience, long-term sustainability, and the potential for attractive, consistent returns.

Our in-house solar business, SunEx, will play a direct role in the execution, operation, and monitoring of the portfolio. The SunEx team, led by an MD with over 20 years of experience, includes electrical engineers, project managers, monitoring personnel, and other solar specialists, enabling us to maintain rigorous control over the performance, reliability, and quality of our solar assets.

This hands-on approach mitigates the risk of underperformance, which can directly impact investor returns. It is important to note that SunEx will charge a market or below-market development and monitoring fee. These fees are not additional costs, but rather reflect the standard fees typically charged by our solar partners for the same services.

This investment is designed to deliver consistent annual income over the 7-year term, alongside the SARS tax refunds in years one and two.

Below are the projected returns and cash flow on the investment in the scenario where both investor capital and debt have been deployed.

This investment is designed to deliver consistent annual income over the 7-year term, alongside the SARS tax refunds in years one and two.

Below are the projected returns and cash flow on the investment in the scenario where both investor capital and debt have been deployed.

| Risk | Description | Mitigation |

|---|---|---|

|

Deployment Risk |

Investors may only claim a tax deduction in the financial year when the solar systems begin generating electricity. For example, if 50% of the investment amount is deployed into operational systems this year, a deduction can be claimed on that portion, with the balance claimable in the following year once the remaining systems are active. |

We will only draw down investor capital once projects have been secured. By doing this, investors only deposit capital with us that has been committed to projects. Any capital not drawn down before the end of February 2026 will be carried over to the next financial year and drawn down then. |

|

Credit Risk |

Returns are dependent on the ability of energy consumers to make consistent payments for electricity consumed. |

The majority of the solar portfolio has an established payment track record, helping to mitigate the risk of non-payment. Each customer or portfolio undergoes a thorough credit vetting process to ensure they can meet their payment obligations. To date, approx. 98% of Jaltech’s existing portfolio of solar projects are meeting payment obligations. |

|

Debt Funding Availability |

Debt providers require investors’ capital to be deployed first before providing a debt facility. If debt is not secured, only a 100% tax deduction would be available to investors. |

We have raised over R400 million of debt for our previous investments; and based on our current discussions with our existing debt provider, the outlook is positive that debt will be raised, though not guaranteed. |

|

Debt Risk |

If the investment has a material default, the debt provider may enforce its rights and repossess the underlying solar equipment. In this scenario, investors could lose their capital and have to repay a portion of their tax benefit. |

We maintain a prudent equity-to-debt ratio to manage this risk and help preserve investor capital. In addition, we believe that the credit risk is low. |

Investors may only claim a tax deduction in the financial year when the solar systems begin generating electricity.

For example, if 50% of the investment amount is deployed into operational systems this year, a deduction can be claimed on that portion, with the balance claimable in the following year once the remaining systems are active.

We will only draw down investor capital once projects have been secured. By doing this, investors only deposit capital with us that has been committed to projects.

Any capital not drawn down before the end of February 2026 will be carried over to the next financial year and drawn down then.

Returns are dependent on the ability of energy consumers to make consistent payments for electricity consumed.

The majority of the solar portfolio has an established payment track record, helping to mitigate the risk of non-payment.

Each customer or portfolio undergoes a thorough credit vetting process to ensure they can meet their payment obligations.

To date, approx. 98% of Jaltech’s existing portfolio of solar projects are meeting payment obligations.

Debt providers require investors’ capital to be deployed first before providing a debt facility.

If debt is not secured, only a 100% tax deduction would be available to investors.

We have raised over R400 million of debt for our previous investments, and based on our current discussions with our existing debt provider, the outlook is positive that debt will be raised, though not guaranteed.

If the investment has a material default, the debt provider may enforce its rights and repossess the underlying solar equipment.

In this scenario, investors could lose their capital and have to repay a portion of their tax benefit.

We maintain a prudent equity-to-debt ratio to manage this risk and help preserve investor capital.

In addition, we believe that the credit risk is low.

| Management Fee: | 2.25% p.a. |

| Performance Fee: | 20% above a hurdle of the investment amount, calculated and charged annually with a high-water mark (with catch-up) – see explanation. |

| Debt Raising Fee: | A one-off fee of 2.5% of the total debt amount, payable upon the successful securing of the debt facility. |

| SunEx Fee: | SunEx will charge a market or below-market development and monitoring fee. These fees are not additional costs, but rather reflect the standard fees typically charged by our solar partners for the same services. |

All quoted returns are net of fees.

Jaltech earns a performance fee annually on returns generated above the investment amount, divided by the total average term of the power purchasing agreements (PPA) signed with the energy consumer. As an example, if the total average PPA term is 10 years, and an investor invests R100, the annual hurdle would be R10.

Accordingly, if Jaltech returns R12 in year one, Jaltech would charge a fee of 20% on the R2 (R12 less R10). If in year two, Jaltech returns R5, no performance fee would be earned. For Jaltech to earn a performance fee in year three, Jaltech would need to return more than R15.

2.25% p.a.

20% above a hurdle of the investment amount, calculated and charged annually with a high-water mark (with catch-up) – see explanation.

A one-off fee of 2.5% of the total debt amount, payable upon the successful securing of the debt facility.

SunEx will charge a market or below-market development and monitoring fee. These fees are not additional costs, but rather reflect the standard fees typically charged by our solar partners for the same services.

All quoted returns are net of fees.

Jaltech earns a performance fee annually on returns generated above the investment amount, divided by the total average term of the power purchasing agreements (PPA) signed with the energy consumer. As an example, if the total average PPA term is 10 years, and an investor invests R100, the annual hurdle would be R10.

Accordingly, if Jaltech returns R12 in year one, Jaltech would charge a fee of 20% on the R2 (R12 less R10). If in year two, Jaltech returns R5, no performance fee would be earned. For Jaltech to earn a performance fee in year three, Jaltech would need to return more than R15.

By simply completing the investment form, Jaltech’s dedicated team will take you through the investment process.

Disclaimer: The contents of this document does not constitute and should not be construed as an offer to subscribe for shares or investment, tax, legal, accounting and/or other advice. For advice on these matters consult your preferred investment, tax, legal, accounting and/or other advisers about any information contained in this document. All mentioned returns in this document are estimates at current tax rates, and past performance is not an indication of future performance. All returns and referencing to investor(s) is with reference to an investor(s) who is in the highest tax bracket.

All reference to investor(s) assumes the investor(s) is a natural person with an income tax rate of 45%.